this link is to an external site that may or may not meet accessibility guidelines.

June 29, 2021 at 10:21PM

https://ift.tt/3dqRYgm

PBR Created a 1776-Can Pack of Beer | Food & Wine - Food & Wine

https://ift.tt/2NyjRFM

Beer

PBR Actually Made a 1,776-Pack of Beer

this link is to an external site that may or may not meet accessibility guidelines.

This content is only available to subscribers.

$1 for 6 Months. Save 98%.

Subscribe Now

Your subscription supports:

Investigative reporting that makes our community a better place to work, live and play

Expert coverage of high school sports teams

The best tips on places to eat and things to do

Daily newsletter with top news to know

Mobile apps including immersive storytelling

In case you missed it (like we did) Texans will be able to buy beer and wine a little earlier on Sundays starting in September.

Sawassakorn Muttapraprut / EyeEm/Getty Images/EyeEmIn case you missed it (like we did) Texans will be able to buy beer and wine a little earlier on Sundays starting in September.

In May, the Texas legislature approved House Bill 1518, which allows for sales of beer and wine to start at 10 a.m. on the Lord's Day. Under current law, beer and wine cannot be purchased until noon in stores.

That all changes on September 1.

Though tubing season may be winding down by then, the change will make last-minute trips to stock up on drinks much easier.

Shiner Beer, based in Texas, reminded fans of the change in a tweet on Sunday.

"On May 28, the Texas House approved House Bill 1518 by a vote of 115-24. We can only assume the 24 naysayers have fully stocked fridges," the beer company's tweet says.

Just as a reminder, in-store liquor sales are still prohibited on Sundays.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/K2SI343HF5P2ZPZQX7G2UJH63U.jpg)

MATERA, Italy, June 29 (Reuters) - Taking time out of high-level diplomacy, German Foreign Minister Heiko Maas bet his British counterpart Dominic Raab a crate of beer over the result of Tuesday's Euro 2020 Round of 16 game between the two nations.

"My United Kingdom colleague and I agree on almost anything in international affairs, but not on who will win at Wembley tonight. So, how about a little wager," Maas wrote in English on his Twitter feed.

"GER didn't lose its last 7 matches at Wembley. Keep it that way," he said after swapping national soccer shirts with Raab.

The British minister accepted the challenge: "We’ve got a case of @bigsmokebrew riding on this. Come on England!" he wrote on Twitter, referring to an English beer manufacturer.

The two men were in the southern Italian city of Matera for a one-day summit of foreign ministers from the Group of 20 major economies. The meeting is due to end just as the game kicks off at 1600 GMT in London, but it was not clear if Raab and Maas would see it together before heading home.

(Refiles to correct misspelling of Maas's name in second para)

Reporting by Crispian Balmer; Editing by Ken Ferris

Our Standards: The Thomson Reuters Trust Principles.

Joc heard Cubs fans buy empty cups for beer snake originally appeared on NBC Sports Chicago

With the mayor lifting COVID-19 attendance restrictions, Chicago Cubs were back in full force at Wrigley Field.

And with them came the infamous empty beer cup snakes.

While some aren't fans of the long plastic testaments to human's desire and need for community, outfielder Joc Pederson is.

"I love the snake," Pederson said during an interview while promoting Pepsi's Ultimate Fan Experience contest. "I think that it's pretty funny."

But some fans will go to ridiculous lengths to build a beer snake, as Pederson overheard while playing in the outfield.

"I heard someone trying to... He said, 'I want to buy your cups for twenty dollars,'" Pederson recounted. "I was like, why don't you just go buy a couple beers? But no, he wanted to buy empty cups. I was like, man, you guys are nuts, but it's funny.

"You're buying empty used cups for your snake."

One estimate had the value of a cup snake at $30,000, not counting buying empty cups on the secondary market.

It's all a part of an atmosphere that's unrivaled, and to Pederson, part of an energy that fuels the players.

"It gives you an energy vibe off their energy, whether it's a day game, night game that's sold out," Pederson said. "The fans are screaming and the beer snake, all that good stuff."

So there you have it, cup snakes give the players energy when they play.

Unfortunately some overzealous fans threw a cup snake on the field, which Pederson didn't love, and their ban might be reinstated.

Click here to follow the Cubs Talk Podcast.

NEW YORK – Ancient Greece and its wine culture were featured in Ancient Origins (AO) on June 26. The taste for salty wine was also explored in the article.

“Not only was wine an important trade commodity that found lucrative opportunities around the world, but it also held a place in both religious and medical arenas,” AO reported, adding that “there was a festival known as the ‘feast of the wine’ and a cult of Dionysus, the Greek God of wine, fertility, and festivity, active in the earliest years of ancient Greece. Euripides, an ancient playwright, even wrote a play signifying the importance of Dionysus and his cult to Greek Culture.”

Hippocrates of Kos, the father of medicine was also mentioned in the article as he “considered wine an integral part of a healthy diet,” AO reported, noting that he also “used wine as a disinfectant on wounds and experimented with different wines to see which one would work best as a good base to mix [into] other drugs and medicines.” Hippocrates prescribed wine “to cure ailments such as diarrhea and pain during childbirth,” AO reported, adding that the ancient Greeks “also recognized that wine also had negative health effects especially when wine was consumed in excess.”

“Many contemporaries noted the ideal amount of wine to drink,” AO reported, noting that “it was suggested that three bowls or Kylix, the Greek drinking vessel, was the right amount to consume. This is still used today as a standard bottle of wine that has 3 glasses in it.”

Homer’s Odyssey also mentions wine “over ten times,” mostly for feasts and religious ceremonies, AO reported, adding that “men were expected to drink wine in moderation, and only when mixed and consumed with food.”

Dionysus is credited with inventing wine pressing, according to AO, which noted that “4th century BC writer Theophrastus, a successor to Aristotle, wrote of the study of vineyard soils and hoped to match them to specific grapevines,” and “left a detailed manuscript on yield rotation and harvesting of plant cuttings to ensure easier cultivation.”

“When the grapes were ready for crushing, wicker baskets were stored inside wooden or earthenware vats with a rope or plank placed above,” AO reported, adding that “the grapes were then crushed” by workers using their feet and “occasionally festively accompanied by music.”

The crushed grapes were then placed in “pithoi” large containers for fermentation, “similar to modern-day casks or drums,” AO reported, noting wine production innovations the Greeks introduced, including straw wine production in which the grapes dry out to become raisins before they are pressed, “creating a more acidic wine for blending.”

The Greeks also added various flavorings, including “resin, herbs, spices, brines, and oils,” AO reported, adding that “mulled wine and vermouth are some of the legacies of this practice.” Retsina is also still popular today and made with resin added.

“Drinking wine that was not mixed with water in Greek culture was considered barbaric,” AO reported, noting that “wine that had not been mixed should only be used as medicine or as a tonic when traveling.”

According to contemporary writings, wine was mixed with “50 parts must, freshly crushed grape juice containing skins and stems, with 1 part seawater,” AO reported, adding that “this was taught by Dionysus after he was threatened by the King of Thrace and hid in the sea.”

The saltwater mixed wine “was known as ‘wine that smells like flowers’ because of the smell that it produces when the must is mixed with seawater,” AO reported, noting that “particularly prominent on the island of Kos” wine mixed with seawater also helped preserve the wine for long voyages and “it was this wine that spread throughout the world.”

Also mentioned by Cato in his book on agriculture, “it is still used, albeit in a small amount, today to produce wines, AO reported, adding that “Thalassitis wine is still being produced and is made by submerging the grapes in seawater before they are crushed.”

Iowa may not be wine country, but that didn't stop the state from producing what one competition named the best sweet Rosé of the year in an international wine competition earlier this month.

Soldier Creek Winery, based in Fort Dodge, walked away from the "THE Rosé Competition 2021" with a Best of Show win for the sweet wine category for its "Paragon Pink" wine.

A Rosé blend vintage 2020, "Paragon Pink" can be picked up for $19 at the Winery in-person or shipped online. Judges said they were "thrilled by its balance of fruit, sweetness and complexity" at the competition, according a news release — and the makers note online that it has strong "grape and strawberry jelly flavors."

The competition was held at the Fort Lauderdale Woman’s Club, in Fort Lauderdale, Florida, on June 18. Hosted by the American Fine Wine Competition, the Rosé-exclusive event had judges test and compare more than 160 entries. Judges went into each wine-tasting blind, with no information about where or when the wine was produced.

More: Windsor Heights bidding war blossoms into unexpected partnership to create R+C's Diner

That method "allows underdog wines from places like Iowa or Rhode Island to shine through, and even win," Judge Sunny Fraser said in the release.

Wine from other unlikely places won other categories in the competition, too: Judges gave the top award in the dry Rosé category to a wine from Newport Vineyard in Rhode Island. More conventional was the best sparkling wine winner: a Sangiovese Brut Rosé from Pope Valley Vineyards in Napa County, California.

More: Secret Admirer patio bar to open this summer with creative cocktails and boozy sno-cones

Judges said they were happy to see wines from different parts of the country winning this year's competition.

"It's great to discover new Rosés coming from non-traditional winemaking states such as Rhode Island, Iowa and Idaho, amongst others," Judge Michael Goldberg said in the release.

Robin Opsahl covers trending news for the Register. Reach them at ropsahl@registermedia.com or 515-284-8051.

One fact proven throughout time is that Ozarkers love the outdoors.

All of the walking, cycling and driving trails in this region are a testament. Along with the outdoor activities, there is also outdoor dining. Whether in the backyard, on the deck or at the park, there is a certain joy from outdoor dining.

Now, to add elegance and opulence to an outdoor meal or get together, there’s nothing better than a sparkling wine.

Unfortunately, when one mentions sparkling wines, the name Champagne invariably comes up. Champagne is French, elegant and very costly. As a result of the higher cost, the wine is often reserved for special occasions and rarely served as part of a meal. Wine is a beverage that should accompany a meal, and that function also must include the sparkling wines.

Fortunately, there are other sparkling varieties that are of equal quality and enjoyment – and are considerably less costly than champagne. Among them are the sparkling wines of the Franciacorta region in Italy. The wines of Franciacorta are very popular in Europe because of their ability to meld with the nationality of practically any meal and will turn simple fare into a feast.

It is now time for sparkling wines to take their turn on the American dinner table.

Lantieri Extra Brut ($30)

This wine, as are most sparkling wines of Franciacorta, is produced using the centuries-old traditional process of fermenting and carbonating the wine in the bottle it will be sold in, which is identical to the method used to produce the French Champagnes. The aroma of this wine is characteristic of all wines fermented in the bottle, hints of bread and yeast enriched with delicate notes of citrus and dried fruits, such as almond, hazelnut and dried figs. The flavors are savory, fresh and enjoyable, and it deserves a place on the dinner table.

Berlucchi 61 Rose ($45)

This Franciacorta rose has an intense pink color derived from the time spent on the skins of the pinot noir grapes used to make this wine prior to fermentation. The aroma presents notes of wild berries and ripe fruit, yeast and bread crust. The red berries with a hint of cherry continue on to the flavor and then to the finish. This wine can even turn tuna surprise, meatloaf or sloppy Joes into a gourmet feast.

Ca d’Or Noble Rose ($42)

Beautiful bottle, beautiful pink color and a beautiful wine. The Ca d’Or sparkling rose captures all the great features of a pinot noir and chardonnay blend in a single sparkling wine. The true aromas and flavors of both varieties shine through and are amplified by the bubbles. This wine can accompany almost any food, and I found it to be a winner with Asian dishes.

Cortefusia Franciacorta Saten ($22)

“Saten” means silk and that word best describes the wine: silky. This pinot noir and chardonnay blend, the same blend that is used for many French Champagnes, can easily rival those costly wines and at a much lower price. The wine has been made as a white wine rather than a rose by not allowing the wine to have contact with the color forming skins. The result is a wine that more favors the chardonnay than the pinot noir by downplaying the red fruits and replacing them with smooth, luscious flavors of the chardonnay.

Cola Franciacorta Saten ($22)

Get the term cola out of your head; the only thing that this wine has in common with soda pop is the bubbles. It’s one of the few vintage-dated sparkling wines from Franciacorta and going one step farther, it is 100% chardonnay. The Cola Franciacorta Saten has the softness, smoothness and elegance that only a totally chardonnay wine can have. This wine is the perfect accompaniment for hors d’oeuvre, seafood, Asian dishes and even with brats while watching the game (don’t knock it before you try it).

Wine columnist Bennet Bodenstein can be reached at frojhe1@att.net.

Vintage Wine Estates has acquired The Sommelier Co., which provides private and virtual wine and spirits tastings.

The Santa Rosa-based wine company said that The Sommelier Co. will help boost its direct-to-consumer business that already represents 30% of its income. The deal was announced Tuesday and is the first one since Vintage Wine Estates became a publicly traded company on June 8.

The Huntington Beach company — which conducts such tastings with certified sommeliers — had net revenue of more than $5 million last year as virtual tastings took off during the pandemic.

“We are thrilled to be able to offer the services of The Sommelier Co. to our direct and business consumers and look forward to expanding the opportunities to present our portfolio of wines to a highly qualified and wine-enthusiastic customer base,” said Jessica Kogan, chief marketing officer for Vintage Wine Estates.

New tasting complex opens in Healdsburg

A new collective tasting complex will open in Healdsburg next month.

Bacchus Landing will be the home to at least seven wineries across five separate open-air tasting rooms. It is just north of Westside Road and east of Dry Creek.

The project is founded by Sonoma County residents Monica and Francisco Lopez along with their parents Al and Dina. The Lopez family also operates Aldina Vineyards, which focuses on premium cabernet sauvignon from Sonoma County. Other wineries include Montagne Russe Wines as well as 13th & Third Wines. Both AldenAlli and Dot Wine will come into the place later this year. Two others will be announced at a later date.

“Over the past 18 months, we have watched the evolution of the Lopez family dream turn into a reality, and we’re honored to have them as strategic partners. The location, design, and energy behind this project fits perfectly with our passion for hospitality,” says Dan Kosta, co-founder of AldenAlli, in a statement. Kosta was a co-founder of Kosta Browne winery in Sebastopol, which he later sold.

Grape growers to hold in-person event

The Sonoma County Winegrowers trade group will hold its annual grower seminar on July 15. The group represents local wine grape growers in the county.

The event will feature a virtual seminar from 8 a.m. to 9:30 a.m. and later an in-person trade show and barbecue at the Luther Burbank Center from 10 a.m. to 12:30 p.m., which will be the first live event for the trade group since the onset of the coronavirus.

More information on the event can be found at bit.ly/3gWzPZP

TURNER, Ore. — Willamette Valley Vineyards is building a new winery in the Dundee Hills southwest of Portland and will hire a new director to oversee winemaking and vineyards, including 65 full- and part-time employees, the company announced on June 24.

Jim Bernau, founder and CEO, said the decision comes as production has vastly outpaced capacity at the current winery in the Salem Hills near Turner, Ore.

"It got to the point where I just couldn't wait any longer," Bernau said. "We have exceeded the design capabilities for this winery."

Founded in 1983, Willamette Valley Vineyards is a leading producer of Oregon Pinot noir. The winery was originally built for making 12,500 cases of wine per year, Bernau said.

Last year, the winery produced 175,357 cases — more than 14 times its initial capacity.

"That creates a lot of pressure on our cellar staff," Bernau said. "What I really need to do is prepare for the future."

Four years ago, the company purchased 40 acres in the Dundee Hills American Viticultural Area along Highway 99 where it plans to build a state-of-the-art winery with the capacity to produce between 250,000 and 500,000 cases annually.

The winery will be within a few miles of Willamette Valley Vineyards' new sparkling wine facility, called Domaine Willamette, which is slated to open in May 2022.

Bernau said the sparkling winery and tasting room is a "considerable investment," with the building and road improvements exceeding $15 million. The site is already home to a mature vineyard, and will also feature a biodynamic garden.

Growth for Willamette Valley Vineyards doesn't stop there. The company is building four winery restaurants, with the first to open before the end of the year in Lake Oswego, Ore. Three others are planned for Vancouver, Wash., and Bend and Happy Valley, Ore.

Along with increasing brand awareness nationally for Oregon Pinot noir, Bernau said the restaurants will only add further demand. He estimates that Willamette Valley Vineyards will need to double production over the next 5-7 years to keep pace.

The company has hired Steven Martin Associates, an engineering firm based in Sonoma County, Calif., to come up with designs for the new winery. There is no timetable or cost estimate yet for the project.

"We're going to move as quickly as we can," Bernau said.

The Salem Hills winery will still be used to make small lots of Pinot noir, with more of the space to be dedicated to wine tastings and hospitality, Bernau said.

In addition, Willamette Valley Vineyards is creating a new position, director of winemaking and vineyards, who will help manage the transition into the new winery while overseeing operations and assisting in the development of brands and products.

Willamette Valley Vineyards owns five vineyards in the Willamette Valley, totaling about 500 mature acres, as well as 35 acres in Eastern Oregon and Washington in the Walla Walla Valley and The Rocks District of Milton-Freewater AVA. The winery also has 500 acres under contract with Oregon growers.

Bernau credits expansion of the winery to its business model, as a publicly traded company with more than 19,000 wine enthusiasts as shareholders.

In mid-June, the winery issued a $10.7 million stock offering to fund the new restaurants. Shares are being sold at $5.05 with a 4.36% annual dividend, or wine credit worth 15% more.

"The foundation of our success is our owners," Bernau said.

According to its latest annual report filed with the U.S. Securities and Exchange Commission, Willamette Valley Vineyards managed to increase sales and income, despite the pandemic. Net sales were $27.3 million, up approximately 10% over 2019, while net income was $6.9 million, a 23% increase.

Each product we feature has been independently selected and reviewed by our editorial team. If you make a purchase using the links included, we may earn commission.

An ice-cold glass of crisp wine can make even the hottest days more bearable. The thing is, ice melts. When it does, you're left with a glass that's half wine and half water, and nobody wants that. While looking for a better way to chill wine this summer, we enlisted the help of La Crema Winery head chef Tracey Shepos, who shared a genius solution to keeping wine cool and flavorful at the same time. I'll be taking her advice all summer long, and here's why you should, too.

La Crema Winery has been making Burgundian-style chardonnay and pinot noir in Sonoma county, California for over 40 years. The brand focuses on growing grapes in small lots that foster bold, distinct, and balanced flavors in every bottle. With flavors so deliberate, it would be a shame to waste a drop. That's why Chef Tracey recommends freezing your leftover wine into ice cubes. When you're ready to pour a glass (I suggest the 2019 La Crema Monterey Rosé), instead of adding regular ice cubes, pop in a few cubes of pre-frozen wine instead.

"Traditional water ice cubes water down the wine, diluting the flavor. I want my wine to taste full, vibrant, and flavorful until the last sip," Shepos tells Food & Wine. Who could argue with that? Freezing leftover wine into ice cubes is the perfect way to preserve those last few sips of a bottle while ensuring each future glass remains boldly flavored. While you're at it, frozen wine cubes can be used in a variety of culinary projects, Shepos adds. Looking to quickly punch up a sad pan sauce? Add a cube or two of La Crema Sonoma Coast Chardonnay. It's a simple way to keep little blocks of flavor on hand whenever you need them.

Here's the most important detail: Remember to label your ice trays so you know exactly what you're adding to your glass each time. Nobody wants to mix chardonnay and sauvignon blanc, so having designated ice trays for each varietal is a guaranteed way to make sure you know what you're drinking.

If you love ice cold wine, consider trying this expert-approved hack to ensure you'll have chilled, full-flavored wine to get you through the hottest days of summer. To help you get started, we've rounded up five of the best ice trays on Amazon for freezing wine-all under $10-below.

These BPA-free silicone ice trays have a removable lid that makes storing and freezing liquids completely mess-free. The clear lids are also easy to label, so you can be sure you know what you're adding to your wine. For even more clarity, designate each color tray for a certain varietal. That way, when you grab the pink ice tray, you know you're grabbing rosé.

To buy: Easy Release Silicone Ice Cube Tray, $8 (originally $9) at amazon.com

The smaller cube size in this two-pack are ideal if you'd like to add a little chill to your wine without overloading the glass with too much ice. Plus, the food-grade silicone makes for easy release.

To buy: Silicone Ice Cube Tray with Lids, $4 at amazon.com

A plastic base makes these ice trays durable, strong, and easy to stack, so if you have lots of leftover wine on hand, consider grabbing a four-pack for just $10. Thanks to the white lining, labeling with a permanent marker is super easy, too.

To buy: Stackable Silicone Ice Cube Tray with Lid, $10 at amazon.com

A giant ice cube lasts longer than a standard one does, so these large cubes will keep your wine nice and cool for hours. Not to mention, when your ice cube is made with wine, it'll act as a built-in refill as it melts.

To buy: Giant Silicone Ice Cube Tray, $8 at amazon.com

If you prefer crushed ice, these mini ice cube trays come pretty close to achieving the same texture and size. The two bendable silicone trays will even produce ice small enough to fit inside a water bottle or reusable wine bottle for your next boozy adventure.

Lisa Howard grew up on a farm in the Suisun Valley in Fairfield, but her passion was math. In the summer she would pester he mom to put together math worksheets.

“But when people would ask me, ‘What do you want to be when you grow up?’ they never asked me, ‘Would you like to be an engineer?’ or ‘Would you want to be an architect?’ she recalled. “They said, ‘Oh, maybe one day, Lisa, you’ll be a teacher.’ Like they knew I liked math, but the closest thing they could get to that was a math teacher. Or a nurse, never the doctor.”

But in high school, Howard already knew that she wanted to attend Cal Poly San Luis Obispo and study agricultural engineering. She got that degree and landed a job as an engineer in Arizona to build irrigation systems.

In Arizona, she met her husband, Cliff, a Phoenix police detective, who convinced her to return to her roots in the Suisun Valley. They did so in 2014 and are now co-owners of Tolenas Vineyards and Winery at 4185 Chadbourne Road in Fairfield. Lisa still uses her engineering knowledge in growing grapes. And she encourages other women to follow in her footsteps.

“For me, it’s really important to make sure that young girls are exposed to all the different career options that they can do and not pigeonhole them into something just because they are a girl,” she said.

She understands the challenges.

“There are starting to be more programs to accept women into college and into these certain careers,” she said. “But then, when they want to be in charge and run the business, that’s another hurdle. I would show up to a project management meeting, and other engineers would say, ‘Okay, we can start this meeting whenever the engineer is here.’ And I would say, ‘Um, that’s me. I’m here.'”

She said the biggest challenge for herself and other women is balancing a business with home life.

“I think a lot of women are scared to start their own business, especially if it’s not a home-based business, because a lot of us still want to be moms and we want to have a family,” she noted. “And you have to find a partner or a husband that is willing to help you at home and take on different roles than maybe they normally would… My husband is very supportive and willing to do anything. But you are still mom and your kids still want you and if you are out running a big business and it’s turning into something very demanding of your time, that balance is challenging.”

The Howards have three children, Jake, age 8, Amy, 6, and Katie, 4. Like Lisa with her parents, they are learning farm life hands-on.

“They have to be part of this life. Otherwise, it doesn’t work for us,” said Lisa. “They are part of what we do, all of the time. Katie was born right in the middle of harvest. And she lived in a backpack, I had my little pouch or she would be sleeping in a little carrier.”

Lisa’s parents, Steve and Linda Tenbrink, are first-generation farmers.

“We watched them as children create this business from scratch, acquiring property slowly and working their butts off,” said Lisa. “I didn’t know what it was like to grow up in town or have neighbors’ kids close by. As I got older and had to start being more and more part of the business, the more I realized that it was probably a little bit too hard of a life for me to want to be part of as an adult. So I made a promise to myself that I wouldn’t be part of the farming life and that I would get a really good job that paid a lot of money and had benefits and health care and all of that good stuff.”

That’s just what she did, landing that well-paying job in Arizona. But Cliff, who she married in 2011, knew where her heart was.

“Cliff has always been talented in the real estate market. He’s always watched it very carefully. He said, ‘I really think that if we ever want to move back to Suisun Valley we need to do this now. The market is going to go up and if we don’t move now I will just be on the path to becoming a career police officer and we will have more children and we won’t want to move them in high school, so let’s move back.'”

“My initial reaction was, ‘You’re crazy. We have such a good life here. Why would we want to leave?’ And he said, ‘Yeah, but I just see it in you that Suisun Valley is in your heart and farming is in your heart and you want to carry on your family’s legacy and I just really have a sense that we should be back there.’”

Lisa reluctantly agreed, even though she had many tearful nights, thinking, “What are we doing? What are we giving up?” She admitted that she still had doubts after the move.

“I kept telling Cliff, ‘What did you do to us? This is horrible!'” she said. “But he was right. And honestly, if we had even waited another month on pulling the trigger on moving we wouldn’t have been able to afford the beautiful property that we were able to buy.”

They bought that 55-acre property in the northernmost section of the Suisun Valley in 2014 and attempted to farm the existing crops — grapes, prunes, pears and walnuts. But after two years, they realized it wasn’t enough to keep them afloat financially.

“When we were trying to decide what we were going to do with this property, how we were going to pay this mortgage, Chuck Wagner of Caymus Winery came into Suisun Valley and was showing interest in the area,” said Lisa. “My sister worked for the Napa Jet Center at the time and Chuck tends to fly in and out of there and we said, ‘Gosh, how are we going to get his attention? How can we get him to come out and talk to us about leasing our property?’ Cliff wrote up a letter and my sister snuck it on the airplane on his seat on one of his flights. And he picked up the letter and the next time we saw Chuck, he said, “Oh, I know who you are!’ And we were able to secure a lease.”

So Caymus ripped out the existing crops, planted the new vineyard and made a deal with the Howards to buy back some grapes but also allow the couple to harvest some of their own grapes.

Another connection helped the Howards secure the building they use as the winery. Lisa knew Bob Hansen, who managed a building next door to the Suisun Valley Fruit Growers cooperative off of Rockville Road. She would go with her dad to pick up supplies there when she was a little girl.

“And so when we were interested in the property,” said Lisa, “I wrote him a letter that said, I know that there are a lot of other people interested in your property. But I vow to keep it in agriculture and to keep the legacy of Suisun Valley going and to make him proud that he was giving an opportunity to somebody who grew up here and not just somebody with millions of dollars.”

Hansen sold them the property which now houses their winery.

Lisa noted that she learned the old-school method of making wine from her parents, but her parents learned it from Abe Schoener, the assistant winemaker at Luna Vineyards in Napa. At a farmers ‘ market, he met Lisa’s mom, Linda, where Lisa had a sign that said, “Wine grapes for sale.” Schoener asked skeptically, “Are you really trying to sell wine grapes in Napa while you’re selling fruit in a farmers market?”

According to Lisa, her mom looked him straight in the eye and said, “Well, you think that my husband’s peaches and vegetables and tomatoes are the best things that you’ve tasted in your life. What makes you think that he can’t grow the best wine grapes?” So Schoener took a look at the Tenbrinks’ property and asked them to build him a winery that he would rent from them. He bought the grapes from them and also taught them how to make wine.

“And so my dad would make wine every year,” said Lisa. “And whenever I would come home to visit, especially if it were during harvest, I would pop in there and it would definitely light something up inside of me.”

That light burned until Lisa decided to move back home, where her parents taught her and Cliff the art of winemaking.

“We really are very low intervention,” said Lisa of their approach to making wine. “So for a lot of our red wines we used native yeast, native fermentation. Sometimes they call that spontaneous fermentation. It’s risky. When you innoculate with a commercial yeast, you have that one yeast that does all of the work from beginning to end. With native yeast it’s not one species, it’s all these different ones that do these different jobs at different times. So when it’s cold there is yeast that is working. As it starts to warm up and the alcohol gets higher, a different yeast takes over and it’s this whole population of lots of different yeasts, which allows for a more complex flavor. It has more dimension to it.

“And we are very gentle in our winemaking. We really don’t have a lot of automation, a lot of fancy equipment. It’s very hands-on, very old school. But I’m still an engineer by trade and I love technology and I love science and I love improvement so I’m always trying to bring in a little twist on that, kind of old school meets new school kind of mentality.”

The Howards won a gold medal at the 2019 International Women’s Wine Competition for their white pinot noir. Lisa said that hit them with the realization that “this is real, this is really a business. We are really doing this, and all of this hard work that we are pumping into this is going to pay off and to just keep going.”

She now has no regrets that she returned home to work the land.

“Our hearts will always be about agriculture,” she said. “Sometimes in the wine world and winemaking and winetasting, people forget that it really is an agricultural product. And that’s where our hearts are.”

To learn more, visit www.tolenaswinery.com.

LANSING, Mich. (WLNS) — That’s a lot of beer: A recent study found that the beer industry had an overall economic impact of $9.9 billion in Michigan in 2020.

The beer industry supported more than 66,000 jobs at breweries, distributors, retailers and more, the study from Beer Saves America found.

“Michigan’s independent, locally owned beer distributors are proud to work hand-in-glove with brewers big and small right here in Michigan, across the country and around the world to help them grow and thrive on a level playing field,” Spencer Nevins, president of the Michigan Beer and Wine Wholesalers association, said in a statement. “This new data makes clear that Michigan is not just the Great Lakes State but also the Great Beer State, and Michigan’s beer distributors are proud to play a role in the beer industry’s continued success.”

A report by the National Beer Wholesalers Association and the Beer Institute showed that Michigan beer distributors employ 4,866 people in well-paying jobs with good benefits.

“Michigan’s beer distributors have deep roots in the communities they serve,” Nevins said. “That was on display throughout 2020 as our members partnered with local distilleries to produce and deliver hand sanitizer to frontline medical workers and nursing homes when there was a worldwide shortage because of the COVID-19 pandemic and supported local restaurants and their employees.”

The beer industry also supports other industries, like agriculture, transportation and manufacturing.

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65):fill(FFF)/d1vhqlrjc8h82r.cloudfront.net/06-28-2021/t_582f9954b9c64d0d9d3a15d083c946af_name_westmelbourne1.jpg)

WEST MELBOURNE, Fla. – A man was shot and killed in West Melbourne while trying to de-escalate an argument between two others, police said.

The fatal shooting happened late Friday near Columbia Lane and U.S. 192 in an area where teens and young adults are known to hang out, according to Sgt. Graig Erenstoft.

[TRENDING: Manatees dying at alarming rate | Latest on Fla. condo tower collapse | Is it legal to drive barefoot?]

Family members identified the victim as 19-year-old Andre Hutchinas, a football player and recent Melbourne High School graduate.

West Melbourne police said Gregory Barr II was arrested on second-degree murder charges in connection with the shooting.

According to police, Barr was in an argument with someone else about beer being spilled on him. Barr then put a knife to the person’s throat, and Hutchinas tried to intervene, police said.

Barr attempted to stab or slash Hutchinas with the knife, but he was able to avoid the strike and punched Barr in self-defense, according to a police report.

Barr then pulled out a gun and shot Hutchinas in the neck, police said. Hutchinas was taken to Holmes Regional Medical Center, where he was pronounced dead, according to investigators.

Erenstoft said it’s disheartening to see someone so young killed over something so trivial.

“It’s obviously tragic. Obviously our hearts go out, our condolences go out to the family but it’s senseless. There’s no reason for it,” he said.

A crowd surrounded Barr, but he threatened them with his gun and told them to get away, police said.

Barr was taken to police headquarters, where he waived his Miranda rights and admitted to shooting the victim, according to the police report.

Video from the West Melbourne Police Department showed partygoers rushing to the patrol car as the first officer arrived on scene to point him to the victim and the suspect.

The officer ran toward a large campfire and yelled for someone to “put the gun down.”

Barr approached the officer with his hands up and followed commands to get on the ground, according to the footage.

As Barr was being taken into custody, partygoers begged the officer to get help for Hutchinas.

“Relax. I’m dealing with one thing at a time,” the officer replied.

The video shows Barr still had a gun in his waistband.

Hutchinas’ mother, Lasondra Pollock, remembered her son as a “gentle giant” who was always making others smile with his jokes and gave the best hugs.

“I mean, his smile would light up the room. He always, he just wanted to have a good time, you know, just innocent fun,” Pollock said.

His goal was to become an entrepreneur.

David Lewis, the president of Palm Bay Rockets football time, said Hutchinas was like a son to him. The two bonded both on and off the field and had grown close over the years.

“He’s just a great kid. This is really hard for me but all in all, I don’t think if he was here he would he would have changed anything. I think he would have done the same thing again,” Lewis said.

Both Lewis and Pollock said it was in Hutchinas’ nature to help others.

“He was loved. You won’t find anybody that’s gonna say anything negative except the kid that shot him,” Lewis said.

A GoFundMe page has been created to help cover his funeral expenses.

Through some convergence of a sponsorship opportunity, a group of star tight ends hanging out, a Top Golf outing, and a mammoth drive by Travis Kelce, you should be getting some free beer sometime this fall.

Kansas City Chiefs tight end Travis Kelce has earned free beer for the team’s fans (who are obviously 21 years of age or older) for National Tight Ends Day, which is clearly the holiday we needed, on October 24. All of this is courtesy of Bud Light.

If you’re still a little confused, don’t worry. We are, too. All we know is that an official press release hit our AA inbox detailing the celebration of National Tight Ends Day with free beer for Kansas City fans due to Kelce’s performance in a recent challenge at a Top Golf location. George Kittle explains the context a bit more here:

Yeah, even that’s a bit of a mystery, but we reached out to Bud Light who confirmed Kelce’s winning shot went over 250 yards (they could not track distances beyond that). For that reason, Kelce won free beer for Chiefs fans, although a Bud Light representative spoke to us saying that details were yet to be worked out or announced in terms of exactly how you claim your free alcohol.

Here’s what we do know: if there was any single NFL player likely to earn you, dear fans, some free beer, I’m pretty sure most of us would have said “Travis Kelce?” in response. His athletic ability, proven production, charisma, and charm are pretty much made for an outing like this.

Kittle, who plays for the San Francisco 49ers, and Kelce recently completed the first ever Tight End University in Nashville this offseason along with Greg Olsen to help come together and share tips for others at the position. Other players who joined them include Zach Ertz, Kyle Pitts, Mark Andrews, Noah Fann, Hunter Henry and dozens of others. The Chiefs were also represented by Blake Bell at the event.

More details from Bud Light likely to come as this fall creeps closer. Remember, as with anything in life, make sure to participate in a responsible manner.

OROVILLE — This weekend saw the return of the North Sierra Wine Trail after a 2020 pause in operations.

Ticket holders were able to visit 11 wineries that span from Oroville to Bangor, continuing to Dobbins/Oregon House and finishing in Sutter Buttes.

Tickets to the two-day event were $30. Included in the purchase was full access to all wineries included in the trail, a map displaying the locations of wineries, and a commemorative wine glass.

The trail took guests through a variety of microclimates, beginning at LIVE VINE Vineyard & Winery — a winery in Oroville that overlooks the Thermalito Afterbay.

Owners of LIVE VINE Vineyard & Winery, Shawn and Susan Smith, said that the trail was something they had been looking forward to returning after the year long absence.

In the break between the 2019 and 2021 wine trails, LIVE VINE has quickly grown. Now as the North Sierra Wine Trail returns for a new year, LIVE VINE is in the process of building a new facility to house an expanded tasting room overlooking the water.

Having participated in the North Sierra Wine Trail since it began, Grey Fox Vineyards said this was a quieter year with the heat. (Riley Blake -- Enterprise-Record)

Mike Beck Sr. performs live music at the Long Creek Winery and Ranch on Sunday. (Riley Blake -- Enterprise-Record)

Grey Fox Vineyards serves participants in the North Sierra Wine Trail on Sunday. (Riley Blake -- Enterprise-Record)

Wine grapes growing on the LIVE VINE Vineyard & Winery property. (Riley Blake -- Enterprise-Record)

A bottle of Grey Fox Vineyards Cabernet Franc. (Riley Blake -- Enterprise-Record)

The third stop on the wine trail was the 27 acre Long Creek Winery and Ranch, founded in 2001 by Lou and Yola Cecchi and now operated by the Phulps family. The winery is located at 323 Ward Blvd. in Oroville.

Owner Mike Phulps said taking over the winery four years ago came with a learning curve, coming into it — “not knowing anything about agriculture or the wine industry.”

Now Phulps said the learning curve has long passed, as he looks forward to the weekends when the winery tasting room opens up.

“We enjoy it,” Phulps said of the North Sierra Wine Trail. “We enjoy being a part of the trail and enjoy the experience of sharing our wines and our foods. It’s something we look forward to every year now.”

Phulps noted that for being a “boutique winery,” events like the North Sierra Wine Trail are a fun occasion, offering a new way for people to experience a variety of wineries throughout the region.

“Every winery you go to has something different. We’re kind of rural out here and you can’t see it from the street and we have a beautiful pond and a creek through the property.,” Phulps said. “We have a beautiful pond and a creek through the property.”

Phulps remarked that despite being in the winery business, there’s no competition in his eyes.

“In the winery business, you don’t talk bad about the other wineries. We support all the other wineries. We keep a map behind the counter if we get someone from out of the area and we encourage them to go see all the other wineries,” Phulps said. “Obviously, we’d like for you to buy a bottle of wine but it’s not necessary to buy a bottle of wine.”

Grey Fox Vineyards, founded in 1996 by the Arrigoni and Cecchi families, was the fourth stop along the wine trail. Located at 90 Grey Fox Ln., owner Jeanne Cecchi said that their winery has participated in all North Sierra Wine Trails since it began.

“We’ve been doing the (wine trail) ever since it started,” said owner Jeanne Cecchi. “It’s kind of a tradition with the only reason we didn’t have it last year being coronavirus.”

As for the 100-plus degree weather, Cecchi said that the trail usually takes place in April when temperatures are lower and because of that, the wine trail has seen fewer visitors this year. But the winery is taking this in stride, offering them more time to get to know the folks that visit compared to busier years.

“It’s going to take some time. People are still coming out and some aren’t used to going out again yet but we’ll get back to normal,” Cecchi said.

Despite the hot weather, it didn’t stop Linda Ginter and 6 of her friends from showing up.

“We like getting together and doing activities all through Oroville,” Ginter said. “We love our community and we want to support it. We’re just 7 ladies out to have a good time and support our community.”

Ginter and her friends who participated in both days of the wine trail made sure to have a designated driver as well.

“We’ve got a designated driver. He’s waiting for us in a van,” Ginter said. “He’s just waiting for us winos.”

The other wine producers along the North Sierra Wine Trail were Munger Family Vineyard, Sicilia Vineyards, Cordi Winery, Purple Line Urban Winery, Spencer Shirey Winery, Renaissance Vineyards and Winery, Lucero Vineyards and Winery, Hickman Family Vineyards, Grant-Marie Winery, and Bangor Ranch Vineyards and Winery.

With the meteoric rise of meme stocks, markets flirting with record highs daily, and valuations vaulted at multiples never before seen, seemingly everyone wants a piece of the investment action these days. Conscious of this inrush, savvy investors are increasingly seeking less traditional asset classes to put their money into, and the diversification strategies to do so are progressively becoming more unique.

It is estimated that $70 trillion of wealth will be transferred from baby boomers to Millennials and Gen Z in the next 25 years, which means a younger generation of people with a lot of money to invest in things they care about. And the ability to make profitable investments based on passionate desires, be they altruistic (socially responsible investing) or egoistic (chasing returns with a fear of missing out mentality), is a motivating factor leading many newly minted investors to evaluate alternative strategies. Whether looking for endeavors that contribute to equitable social evolution or a hedge against inevitable corrections to traditional financial markets, investors are flocking to a host of non-traditional, tangible commodities.

Which is where fine wines and brown spirits come in. While in the past investors have shied away from alternative assets, like coins and antiques, due to fears of illiquidity and opaque valuations, the emergence of wine and whiskey investment portfolios — and really the sheer variety of fractional, democratized investment opportunities created in the last few years — underlies a greater shift to financialize pretty much everything, and signifies a newly defined approach to investing. But are they really the safer bet?

Fine wine is an area that has witnessed significant growth recently, and the sector is poised to break out, as a number of firms and investment gurus, after eyeing several years of compelling returns, are expanding their holdings.

London-based Liv-ex promotes itself as the global marketplace for wine. The firm produces reports detailing market movers and valuations, documenting record growth in sales volume and value in the past year. With the renewed interest in wine collecting and investing spurred by the pandemic, certain varieties and vintages have seen values skyrocket. Not surprisingly, Champagne and Burgundy remain two of the most sought after and best-selling in the investment sphere. And the most traded fine wines of the last year, according to Liv-ex, included Lafite Rothschild, Petrus, Screaming Eagle, Mouton Rothschild, Sassicaia, and Taittinger.

In a 2020 article suggesting that investing in wine was essentially a way to ‘Covid-proof’ a portfolio, Forbes reported that $100 invested in wine in 1952 would be worth $420,000 today, while the same amount placed in the stock market would equate to $100,000. The numbers are impressive, but the claim begs the question of whether storage costs were taken into account, and these returns are likely based on assumptions that the proper labels and vintages were purchased.

Wine investment firms like Vinovest are well aware of the issues at hand when it comes to managing fine wine portfolios. The company, founded in 2019, handles all acquisition and sales responsibilities, storage, insurance, and portfolio management for a 2.85 percent annual fee, a number that drops to 2.5 percent with a $50,000 commitment.

Like other apps aiming to simplify investing, Vinovest offers access to the wine investing world through algorithmic mechanisms that take into account a client’s risk aversion and market fluctuations to identify strong investment portfolio strategies. The company is working to release a wine value index tool, comparable to the S&P, which offers live valuation indices.

When asked about the motivating factors drawing investors into asset classes such as fine wine, Vinovest co-founder and CEO Anthony Zhang says that three issues are driving interest: “diversification and low correlation during downturns” combined with “double-digit annualized returns over the past couple decades” and younger generations’ commitment to investing in ideas and products that they are passionate about.

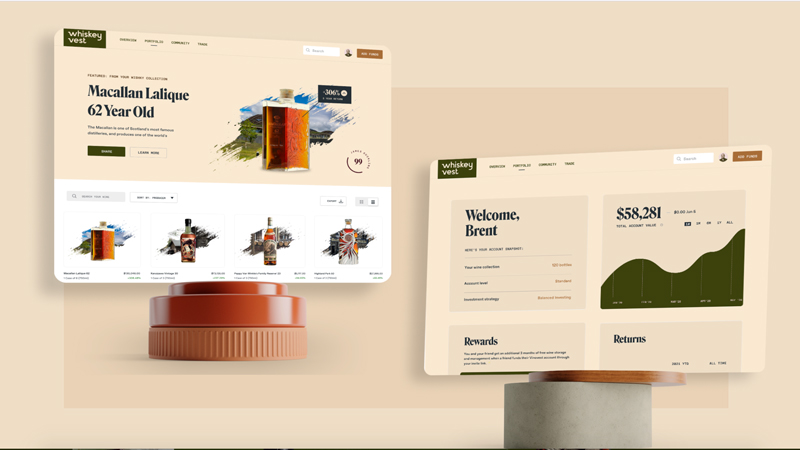

After striking liquid gold with Vinovest, the team recently turned to another liquid venture, Whiskeyvest. Currently accepting members by invitation only, the company promises to “make investing in rare whiskey simple and accessible.” Focusing on exclusive bottles, Whiskeyvest highlights The Macallan’s 62-year-old single-malt Scotch — and its recent 143 percent appreciation — on its landing page.

Investing in whiskey and Scotch is a hot topic, and while the opportunity was traditionally only available to distillers and producers, investment groups are now purchasing casks, aging them in distillers’ bonded warehouses, and selling shares to the public. Scotch whisky investment firm WhiskyInvestDirect reports that Scotch has realized annual returns of 15.4 percent annually over the past decade.

Rare Whisky 101, the Scotch industry leader in valuation tools, compiled data covering 64,201 bottles and 727,268 transactions since 2003. The statistics indicate that Scotch has consistently outperformed the S&P.

As the industry is in its infancy, a multitude of variables are at play when it comes to investing in rare whiskey. Producers are now limiting production and creating ultra-rare vintages in an attempt to capitalize on trends. How this affects the market in the future remains to be seen. With supply and demand lying at the heart of all financial transactions, the advantage of the product being consumable is a significant factor that is difficult to project.

As with wine and whiskey, those who emerged from the past year flush with cash are pouring excess reserves into a variety of innovative investment opportunities. Real estate, typically a safe haven for wealth, is on fire in terms of popularity and capital in-flight right now, and other assets including art, watches, handbags, jewelry, and luxury goods are appreciating handsomely with renewed financialization schemes.

Luxury handbags are the only sector to record better returns than fine wine last year (up 17 percent), according to the Knight Frank Luxury Index. Hermès handbags, specifically, are a status symbol, and some models qualify as the most difficult consumer products to acquire, with extremely limited production. Demand far outpaces supply, and second-hand bags routinely sell for substantial markups. Baghunter documented a 500 percent increase over 35 years, with annual returns averaging 14.2 percent. Startup RSE Archives, doing business as Rally Road, identified the unique position held by luxury handbags and is now offering investors the option of purchasing shares in crocodile skin Birkins. The firm is not new to the investment game and has been allowing clients to invest in rare cars and baseball cards in a similar fashion.

Fine art has long been considered a strong capital asset, but the recent trend toward increased financialization in the art world offers even more diversification strategies for creative portfolio managers. New York-based Masterworks developed an organized art market where investors purchase shares in blue-chip masterpieces. The company buys works of renowned artists, securitizes the pieces with the Security and Exchange Commission, and then sells shares to interested buyers. Investors have the option of holding for three to 10 years until the firm resells the appreciated item and profits are split, or shares can be traded freely on the secondary market.

Watches are a favorite option for high-rolling investors. The luxury watch market is highly speculative, but collectors typically believe value exists in classic lines such as Patek Philippe’s Calatrava and the Day-Date President Rolex. Rocker John Mayer has a world-class collection, and his whims influence the market in a similar fashion to how Elon Musk’s musings impact the cryptocurrency universe.

Speaking of cryptocurrencies, their explosion is shifting the foundations of financial markets. Uncertainty abounds, and the soon-to-be-announced Federal Reserve version is expected to upset current prices by drawing institutional capital to a more centralized crypto model, but to what extent is anyone’s guess.

Lastly, non-fungible tokens, or NFTs, have taken on a life of their own, with a host of companies, including BitWine, betting on the newly found market by combining digital art with iconic wines.

While bubbles are lovely in Champagne, they tend to be quite dangerous in financial markets. Though the ride to the top feels good, and nobody ever likes to believe that it’s about to be over, the past 15 months have been a genuine rollercoaster testing the credulity of investors and the credibility of the markets as a whole.

From today’s perspective, with markets soaring and businesses reopening, it is easy to forget how dire the situation was financially last year, and how incompatible the current fiscal situation is in relation to common sense. (As reported by Current Market Valuation, the current price-to-earnings ratio is 37.1, a number that suggests the stock market is strongly overvalued, with the ratio measuring the stock price relative to gross revenues 89 percent higher than normal and 2.3 standards of deviation above average.)

Illogical valuations are being fueled by unprecedented capital injections meant to stymie pandemic-related losses and disruptions. The market crash that occurred in March 2020 spooked investors, routed 401ks, and created a crisis that allowed for fiscal policies that would have raised serious red flags in any normal situation. While the numbers don’t lie, an important question remains: When will the bubble(s) pop? While nobody knows exactly what will trigger the event or when, a new wave of financial wizards are allocating to uncorrelated assets like fine wine and whiskey to ride out the storm that many are forecasting. With captivating returns and the allure of owning rare vintages, the industry is set to continue its rise in popularity.

What remains to be seen is how uncorrelated these asset classes truly are. The common thread that ties the various instruments together is consolidation at the top of the scale. Inflationary pressures are exacerbating social stratification, and the best returns are being realized by investments that target the extreme high end of the luxury markets. With the majority of the population excluded from participating, the sustainability of the business models and the eventuality of a correction are two factors that will be unraveled as time goes on.

Vinovest’s Zhang believes that wine and whiskey will perform well, even if financial and equity markets experience precipitous declines. If recent downturns are any indication of future results, he just might be right. A peer-reviewed study published in 2010 found that wine valuations are “primarily related to economic conditions and not to the market risk.”

Valuations are a sticky, subjective topic, as an asset is only worth what someone will pay for it. If there is no buyer at the top, things can get ugly quickly (for example the 17th-century tulip mania craze). As Aaron Sorkin put it, “For the rest of us to profit, we need a greater fool — someone willing to buy long and sell short.”

With markets screaming higher and money flowing more freely than ever, it is easy to get caught up in the excitement. All investing carries risk, but it’s by balancing these risks and diversifying portfolios that financial masterminds work their magic. While there are practically limitless tangible assets and traditional securities to choose from, one of the advantages of investing in rare wine and whiskey is that even in the event that profits are not realized, losses can be toasted away with a pour from the portfolio.

This story is a part of VP Pro, our free content platform and newsletter for the drinks industry, covering wine, beer, and liquor — and beyond. Sign up for VP Pro now!

Published: June 28, 2021

sela.indah.link PBR Created a 1,776-Can Pack of Beer | Food & Wine Skip to content ...